Optimize Triparty Collateral Management and Reduce Operational Risk

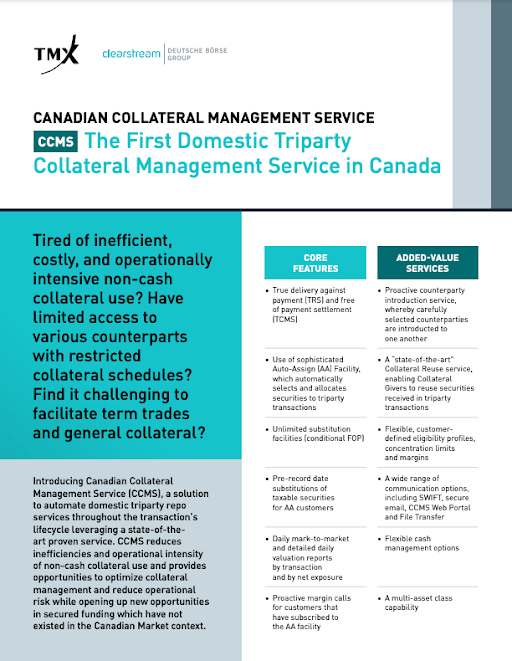

As the Canadian secured finance industry grows, so does the need for efficient triparty collateral management solutions. The Canadian Collateral Management Services (CCMS) is an innovative solution that optimizes and automates domestic triparty Repurchase Agreement services throughout the transaction's lifecycle.

The First Domestic Triparty Collateral Management Service in Canada

In Partnership with Clearstream

CCMS is a collaboration between TMX Post-Trade Innovations Inc., an indirect, wholly-owned subsidiary of TMX Group Limited, and Clearstream, the international central securities depository (ICSD) of Deutsche Börse Group. The CCMS facilitates the use of repo as an investment product, especially with the upcoming cessation of Banker’s Acceptance and an industry shift to the T+1 settlement cycle in 2024.

With CCMS, market participants can:

Optimize

Optimize collateral with real-time substitution throughout the business dayConnect

Connect currently fragmented collateral pools into automated collateral rails across the marketGo Beyond Investment Process Efficiency

The CCMS makes it easier for clients to onboard and streamline their investment process. It leverages Clearstream’s close market interaction and experience to help Canadian buy and sell-side market participants manage risks and liquidity more efficiently. It also enables clients to benefit from various funding sources, collateral mobility and outsourced settlement and administrative functions.

Sign up For Updates

Subscribe to our CCMS Horizons Quarterly Market Update!

For more information, email CCMSInquiries@TMX.com. A member of the CCMS team will be happy to meet with you.