Securities Depository, Custodial, Entitlement

CDS offers a comprehensive range of depository, custodial and entitlement services that span the lifecycle of securities issues:

Book-entry-only services

A book-entry-only (BEO) issue is one where the issue is registered in CDS's nominee name (CDS & Co.) on the register of the issuer and is deposited with CDS for the life of the issue. Physical certificates are not available to beneficial shareholders for BEO issues.

Issuers must complete a BEO Securities Services Agreement and a BEO acknowledgment to advise CDS which securities are eligible for the BEO services of CDS. The BEO Securities Services Agreement along with the Issuer Procedures set out the provisions by which CDS will hold securities in its nominee name and ensures entitlements are distributed to participants on payment date.

CDS Issuer Services

CDS provides significant value in working directly with securities issuers or their appointed agents in support of a variety of aspects of securities issuance, administration, and entitlement processing.

Custodial services

As Canada's national securities depository, CDS manages the safekeeping of depository-eligible domestic and international securities in both electronic and physical certificate form for its participants.

CDS-eligible securities are held by CDS or transfer agents and registered in CDS's nominee name (CDS & Co). Once the electronic or physical securities are deposited with CDS, CDS enters them into a ledger and they trade electronically.

Dematerialization

Today's rapidly evolving business landscape requires CDS, Canada's national securities depository, to continuously seek out new ways to serve our broad range of clients more efficiently and effectively. Advances in technology within the financial industry have enabled CDS to move beyond physical certificates and to implement fully electronic processes for facilitating registry, custody, settlement and transferability of securities. The elimination of definitive physical certificates, or securities dematerialization, will result in lower costs as well as enhanced settlement services.

Corporate Actions (Entitlements) Information Services

Because CDS is the nominee security holder of record for most Canadian securities, transfer agents must provide CDS with primary-source entitlement information from issuers. Being first to receive most entitlement data establishes CDS as an authoritative source of Canadian entitlement information to the securities industry. CDS's electronic Bulletin service provides information on corporate events that participants and subscribers can pass on to their clients.

ISIN Eligibility service

CDS is the national numbering agent (NNA) for the issuance of ISIN numbers in Canada. Once a participant acting as issuer, agent or underwriter has purchased an ISIN or CUSIP® through CDS, the participant must use CDS Clearing's ISIN Eligibility application to request their issues' eligibility in CDSX.

CUSIP®

CUSIP (Committee on Uniform Security Identification Procedures) is a standard system of securities identification and securities description that is used in electronically processing and recording securities transactions in North America.

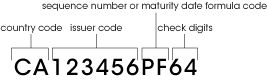

ISIN

ISIN (International Security Identification Number) is an international code that uniquely identifies securities. Every CDSX®-eligible security requires an ISIN. Below is an example of the ISIN number format for a common financial instrument.

Shareholder meetings

CDS compiles and summarizes information on shareholder meetings and record dates gathered from a variety of sources, including issuers and their agents. The information is updated on or about the first business day of each week. Once a meeting date is listed, CDS asks issuers or their agents to report any errors or changes in dates. The listing is available to the public by CDS Innovations.

Strip bond services

Since 1987, CDS has been reducing risk and costs to the financial markets through the electronic stripping of debt securities. As a result, Canada's financial community can separate or strip many securities into component parts that can be held and traded separately. These parts are used to create new investment products that:

- reduce reinvestment risk

- increase yields

- raise the potential for capital gains

- produce cash flow.

CDS's strip services include book-entry stripping and reconstitution, physical strip bond deposits and book-entry strip bond packages.

Trust indenture providing for the issuance of debentures

The sample trust indenture was developed in conjunction with transfer agents and is provided for general information purposes only and does not constitute professional, legal or other advice. The user should seek appropriate, qualified professional advice before acting or omitting to act based upon any information provided in this document.

Tax services

Tax Exempt Dividend Service (TEDS)

As of April 28th, CDS Participants who require end-user access to the TEDS application must reach out to their CDS Relationship Manager via the cdscustomersupport@tmx.com e-mail to request this.

CDS offers DTC's Tax Exempt Dividend Service (TEDS) that allows tax-exempt U.S. holders of Canadian securities held at The Depository Trust Company (DTC) to receive the full amount of their entitlement payments immediately without filing tax refund claims with Canada Revenue Agency (CRA). For tax-exempt participants, CDS pays the participant the full entitlement on a Canadian security declared in U.S. funds. For non-exempt participants, CDS pays the entitlement, less the applicable tax, which it sends to Canada Customs and Revenue Agency.

Qualified Intermediary

In keeping with U.S. Internal Revenue Service (IRS) withholding regulations, CDS assigns all participants to one of the following IRS tax classifications:

- Non-Withholding Qualified Intermediary (NWQI)

- Withholding Qualified Intermediary (QI)

- U.S. Participant (USP)

- Non-Qualified Intermediary (NQI)

Non-resident withholding taxes

CDS acts as the Canadian withholding agent on all Canadian dividends, interest and trust income paid to the Depository Trust Company (DTC) for securities on deposit at DTC. Prior to any given entitlement payment, DTC solicits the U.S. financial institutions that hold the security in its depository for withholding instructions on the payments that DTC will make to these financial institutions on payable date. DTC summarizes these instructions and provides a single withholding instruction to CDS on the amount of tax that is to be deducted by CDS. CDS withholds accordingly, remits the net payment to DTC and sends the tax to the Canada Revenue Agency (CRA). CDS does not do any other tax reporting on the payment.CDS does not have access to information regarding the underlying investors and their residence status.